The Humanity Party®’s Fair Tax Plan—How To Pay for Government and Social Programs

October 18, 2015 |

| 22 min read

The Importance of Government to the World’s Economy

Reducing government spending negatively affects the global economy.

World governments are the largest employers and provide more income to people than any other entities upon Earth. A government’s vast employment network includes, but is not limited to: a workforce of civil servants (elected officials, judges, lawyers, law enforcement personnel, etc.), postal workers, military personnel, contractors, entities that receive government subsidies (including many farmers and landowners), and businesses that are bailed out and now indebted as a result of government funding. These employees are paid from tax dollars. Included with the federal or national workforce are local government employees, teachers, firefighters, and other law enforcement employees. If government spending is reduced by eliminating government workers, who directly benefit from taxation (the source of their paychecks), the world’s consumption-based economy will collapse.

The world’s governments cannot (and should not be expected to) work with a balanced budget that only spends the money that they receive through the taxation of the people, which includes the businesses that the people create in a free market system. Every competent leader knows this. Government does not have an umbrella insurance policy—or any other insurance policy for that matter—that reimburses it for unforeseen costs associated with unexpected events such as war, domestic and foreign social expenditures that pay the consequences of free-willed human action (criminal activity, protests that end in violence, and the likes) or natural disasters. No government can create a budget that allows for a savings plan to pay for unexpected future events. This is simply not possible.

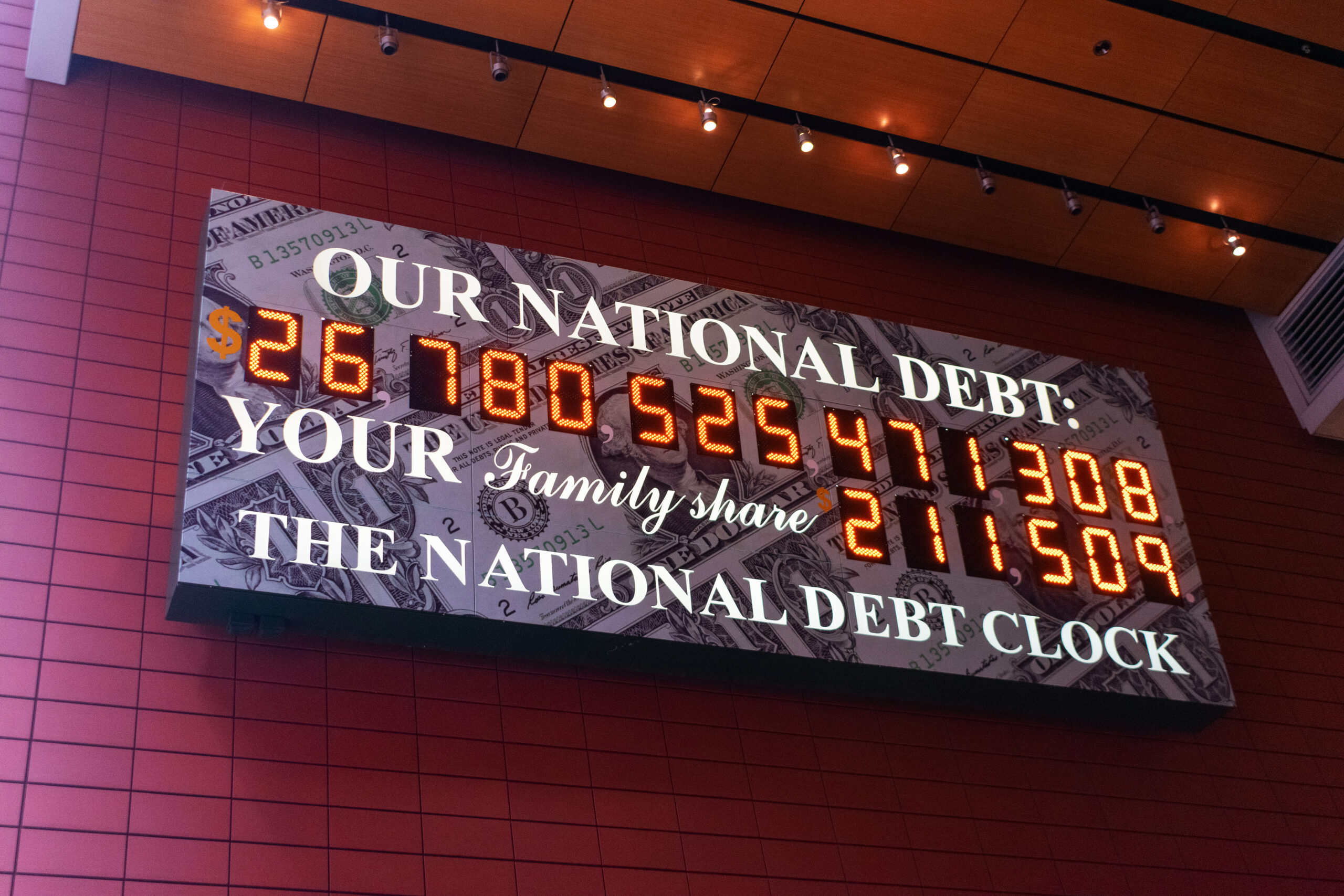

National debts allow for funding of government operations and programs. They grow larger every day. All countries’ national debts will continue to increase exponentially according to the needs of the people.

There is not enough mined gold upon Earth to payoff even the United States’ national debt. It is estimated that about 6 billion ounces of gold have been unearthed during the entire recorded history of human existence. If all of the unearthed gold had a value of $2,000 U.S.D. per ounce, it would only be valued at 12 trillion dollars, which would not come close to paying off the U.S. National Debt. Once governments figured out that the gold standard was not sustainable, they started printing money on paper, which led to greater instances of inflation.

Paper money has no real value in and of itself, except for that which the people give it. Inflation is the direct result of an increased money supply. Inflation is determined by supply and demand. In other words, the price of a good or service that a person offers to others is based, not on its real material value, but upon what the consumer will pay for it. A person (or business entity) becomes wealthy when the goods or service that the person offers is in demand by others. The person might charge $1.00 for a good or service at first and be satisfied with the profit, given that the price charged is based on the person’s desire for profit. Although the person is satisfied with the profit made from $1.00, once the person realizes that the consumers have more money available to them and can then pay more for the good or service, that person will inflate the price (inflation) accordingly in order to make a larger profit. This is how Capitalism and the Free Market work.

The argument is made that Capitalism and the Free Market economies are primarily responsible for technological advancements and the rise of human initiative and innovation. This is simply not true. Although the market does increase a person’s desire to invent something that can be sold, government spending is primarily responsible for the rise of our physical standard of living. Because only a government can legally print money, government funding of research and development (predominantly for military purposes) has been responsible for many of the things that humans depend upon in support of a higher standard of living. Government grants to individuals and organizations are responsible for many of the things upon which the human race has become dependent.

Humans cannot use their reason and intelligence to imagine and invent things if they are constantly forced to concentrate only on their day-to-day survival. Most human-inspired inventions, from the first forms of ancient writing to modern computer sciences, were made possible because of financial grants from governments that freed people up from normal physical labor and allowed them to think.

The development of nuclear fission that led to the Atomic Age is credited properly to German government financing of military research and development. Another important example of the necessity of a strong government and the money that it can create, is the case of American, Eli Whitney. Whitney is famous for his invention of the Cotton Gin—a machine that eliminated human labor in the cotton fields in the early United States. Whitney is known as one of the first pioneers of American manufacturing, especially in the field of mass production. However, this would have not been possible without the intervention of the military branch of the U.S. Government. Due to the weak patent laws that existed at the time, Whitney made very little profit from his machine. The U.S. Government, acknowledging Whitney’s innovation and skill, stepped in and offered him a lucrative contract to build muskets for the military. Without the government’s help, Whitney would have died a pauper.

If a government creates money to improve life for people by providing paychecks for them, taxing their paychecks seems counterproductive. If all the people upon Earth are dependent upon a government paycheck, directly or indirectly, and then that paycheck is taxed, or money is given back to the government, why not simply reduce the original amount of the paycheck?

Government:

Here is $100 for your services, but give me back $20 so that I can pay you next time.

What?

This is why governments are insolvent and in debt. However, a government’s sustainability is not currently based on how solvent it is (how balanced its budget is), but rather in its ability to repay debt. Each country is given a credit rating by U.S. dominated financial groups. Since it is impossible for any country to become completely debt free, why are people’s incomes taxed?

People work to receive a paycheck so that they can buy the goods and services that they want and can afford, from other people. The more disposable money a person has (the larger the paycheck), the more goods and services that can be purchased. The wealthier a person is, the more goods and services that person can purchase to enhance life. Poor people do not have the money to purchase the goods and services that the rich enjoy. The money the poor receive from their paychecks goes towards life’s basic necessities. The world’s economy is based on consumption—buying goods and services. The more money people have to spend, the better the economy.

Consumption-based Taxation

If there were no income tax, the people would have more money to spend. If taxes were instead solely based on consumption, then the wealthiest people that can afford to buy goods and services would pay the most taxes. But they would not be forced to … they would make the choice to. If a rich person wants a boat, for example, and the taxes are included in the price of the boat, the buyer knows the exact cost of the boat, and will not purchase it if the price is not right. The boat company will not sell any boats unless the consumer can afford to purchase them.

A consumption tax controls inflation because companies are not going to raise the price of their goods and services if people cannot afford them—and the higher the price, the greater the tax. And given that the wealthy have all the money, they will be forced to pay their fair share of taxes, if they want to maintain their wealthy lifestyle. If the wealthy want a boat, a 20% consumption tax rate is not going to stop them. In fact, they will feel much better about paying a tax that is not forced upon them. Likewise, a poor person who wants a hamburger from McDonalds® is not going to mind paying 20% more for the right to eat a hamburger.

The problem with consumption based tax rates and why they haven’t worked or been accepted by governments is because of the effect the consumption rate would have on the poor and needy, who would be subject to the same tax rate as the wealthy. For this reason, a proper consumption tax should only be applied to the goods and services that are not necessary for human existence, i.e., providing the basic necessities of life. These goods and services should not be taxed.

Most importantly, governments can and should be mandated by law to provide the basic necessities of life to all people equally as part of their budgets (see our Proposed Constitution, Article IV, Section 2). These vital social programs will then be financed through a consumption-based tax (see our Proposed Constitution, Article I, Section 9). When the government is forced to print money to fund these necessary social programs, the people who provide the goods and services for these programs will make a lot of money from the government contracts and grants mandated by law. The more money the people make, the more they will consume. The more they consume, the more taxes they will pay. This will eventually result in the government printing less and less money and the end of all taxation.

A government’s spending is funded through taxes. And thus supported through taxation, the government then supports the economy through government spending. Under a consumption-based tax rate, as the government spends more, and the people receive larger paychecks, the people will spend (consume) more, which will result in more taxes going to the government. A worldwide consumption tax rate on all goods and services that do not support the basic necessities of human life will eliminate all other forms of taxation. Eventually, even the consumption-based tax will be eliminated.

Simple mathematical algorithms can determine the tax rate:

(Allowing that, by law, the consumption-based tax rate cannot exceed 20%):

Gross Domestic Product (GDP) is the goods and services provided in a market. Whenever and for whatever one spends money, one adds to the GDP. Government Spending (GS) is what the government spends for social programs and its own operations.

The Tax Rate to be charged on the consumption of all goods and services outside of those required to support the basic necessities of life is determined by this simple equation:

(GS) ÷ (GDP) = TR (consumption tax rate).

Because there will be a cap of 20%, by law, there needs to be an equation to determine how much new money is required. The amount of new money (NM) needed to pay for government programs is determined by this simple equation:

NM = (GS) – (GDP x .20)*

*The new currency needed would be the difference between the actual tax rate required to pay for government spending (GS) and the set 20% tax allowable by law. The new currency would increase the Gross Domestic Product for the following year, thus lowering the amount of new money needed to support the people’s needs.

Here is a graph (as an example) of what will happen when the algorithms are applied to a consumption-based tax along with printing enough money* to cover government spending (all amounts are approximated to their nearest decimal):

| Year | GDP (in trillions) |

GS (in trillions) |

Tax Rate | New Money (in trillions) |

|---|---|---|---|---|

| 1 | 15 | 5 | 20% | 2.00 |

| 2 | 17 | 5 | 20% | 1.60 |

| 3 | 18.6 | 5 | 20% | 1.28 |

| 4 | 19.9 | 5 | 20% | 1.02 |

| 5 | 20.9 | 5 | 20% | 0.82 |

| 6 | 21.7 | 5 | 20% | 0.66 |

| 7 | 22.4 | 5 | 20% | 0.52 |

| 8 | 23 | 5 | 20% | 0.40 |

| 9 | 23.4 | 5 | 20% | 0.32 |

| 10 | 23.7 | 5 | 20% | 0.26 |

| 11 | 24 | 4 | 17% | 0.00 |

| 12 | 25 | 4 | 16% | 0.00 |

| 13 | 26 | 4 | 15% | 0.00 |

| 14 | 27.3 | 4 | 15% | 0.00 |

| 15 | 28.7 | 4 | 14% | 0.00 |

| 16 | 30 | 4 | 13% | 0.00 |

| 17 | 32 | 4 | 12% | 0.00 |

| 18 | 34.5 | 4 | 11% | 0.00 |

| 19 | 38 | 4 | 10% | 0.00 |

| 20 | 42 | 4 | 9% | 0.00 |

With the new mandates on the government to provide education, healthcare, and social welfare, government spending (GS) will increase each year; but the economy will improve as people spend their money on other things. Taken into consideration is the influx of new money into the economy and the non-existent tax obligation of corporate earnings from the companies that provide the means of education, healthcare, and welfare, etc. under government contracts. The GDP will rise substantially and exponentially. And as the GDP increases, the tax rate will go down accordingly. After ten years, it is assumed that the people will become less and less dependent upon government support and increasingly engage in the free market where they can buy things that are over and above their basic necessities.

In the above graph, the new money is added to the next year’s GDP because people will spend the new money. The then increased GDP, taxed at the same rate, will reduce the amount of new money needed for the coming year. As indicated by the graph above, eventually there will be no need to print more new money, as there will be a surplus if the tax rate algorithm remains the same. Once there is a surplus, and no new money is needed, the tax rate will begin to fall as the GDP increases. As the tax rate decreases, people will have more money to add to next year’s GDP.

New money needs to be created (printed) so that it can become available for the use of all people involved in buying and selling goods and services to each other, thus increasing the GDP. Currently there is not enough money for everyone to be involved in the market place equally.

America’s influence and world power are based on its consumerism. The power of the American consumer to regulate international supply and demand quotas and trade currently obligates and controls all other nations under its umbrella of consumerism in pursuit of the American dream. With liberal immigration policies, more people will come to America. The more people who participate in the economy, the more money that will be needed to support that economy. The more money people have, the more they spend. The more they spend, the more the GDP increases. The more opportunity to make money, the less and less the people will depend on the basic government-provided goods and services, wanting more than just the basics, thereby decreasing GS exponentially. As people work harder to acquire everything outside of their basic needs that are provided by law, the GNP (Gross National Product) increases as they buy the entertainment and luxuries that they want, the nicer homes that they want, and the food that they want, all taxed at the flat-rate consumption tax. This will bring more money into the government’s coffers that will need less and less money as the economy improves.

A side note: world progression towards a more tranquil civilization will increase when other nations realize that their citizens want what America offers, motivating foreign governments to improve the lot of their people so that they will stay in their countries. In addition, as other countries produce the products that Americans want (because it is more beneficial to an American corporation to make a profit from law-mandated goods and services that Americans need), these foreign economies will improve.

Monopoly®

We will use the game of Monopoly® to explain the implications of this form of taxation, providing new currency, and how this Constitutional provision supports The Game of Life as played out in America, while creating an equal playing field for all.

Using the scenario of playing Monopoly®, it becomes very clear how the poor remain poor, and their numbers increase daily, while the rich remain rich and control the economy, as well as control business law and the government. A few players eventually own all the land, the utilities, and transportation (railroads). Those who don’t own land are still required to pay rents, utilities, and to “take a ride on a railroad” if they want to remain in the game. Eventually, because the Banker only has a limited amount of currency, those who don’t own the limited resources and receive an income from rents won’t have enough money to continue playing the game and will eventually lose the game to bankruptcy.

What is not part of Monopoly® are spaces where a player can land on a job. “CHANCE” and the “COMMUNITY CHEST” are the only sources of other income to the players who do not own land or the spaces that demand payment. However, a player can be affected economically both positively and negatively per chance and being helped by the community. If more jobs were created, the players would have a greater opportunity to stay in the game.

But what about the limited amount of money provided by the Banker that eventually lands in the hands of the few wealthy players? When there’s no more money, how is anyone supposed to continue to play the game? And when you open the game to new players (birth, immigration, trade agreements with other countries, etc.), what are these new players going to use to play the game? The answer: print more money so that the new players can play. But even so, no matter how much money you print, and no matter how many new players sit down and begin playing, the money will always end up in the hands of the rich who own all the spaces where some kind of payment is required.

In essence, our proposed new Constitution provides additional spaces and changes the rules for some spaces so that the other players have the opportunity to play the game longer, in fact, indefinitely, if they so choose. There’s only so much land to be owned, utilities to be owned and profited from, and railroads to ride. The playing board’s space is limited. But the ability of more and more players to play the game and be provided with the money to do so is limited only to the rules applied to the game. Therefore, the rules themselves must be changed.

All of the spaces were bought up before the new players had a chance to enter the game. To play, they have no choice but to roll the dice and see where they will land and to which rich person they will pay money. The number that comes up from chance in rolling the dice is the problem. The players are forced to roll and pay whatever the owner of the space requires. The rents depend on how much money the space owner put into the space’s development (how many houses or hotels).

The only way to keep people playing the game, and maybe have the opportunity to enjoy the game, is to change the rules. THERE IS NO OTHER WAY!

But the first thing to consider is: why is a person forced to play? Why can’t a person simply sit around and watch? One of the reasons is because Monopoly® (i.e., Capitalism) is the only game in town, and if you want money and the opportunity to own land and play, even the money necessary to live, there’s only one way to do it: play the game according to the rules. But what if you don’t want to play the game?

If you exist, you shouldn’t be forced to play the game. And if the game provides the only means for existence, then the rules of the game MUST be changed to, first, benefit the players who want to play and who have benefited from playing the game, by having them support the non-players; and second, make the game worthwhile for everyone in the room.

A huge motivating factor in playing the game is to be able to say that you were successful at it—that you won! Other non-players might be impressed more, if, by your playing the game, they also benefited from your play. Just think how popular and well liked those would be who helped the non-players by providing them with snacks and a comfortable chair from which to sit back and observe the game. The thing is, the onlookers are going to become bored if they are only watching, when, upon observing the game, they are continually strategizing in their own minds how to play the game and to win themselves. Furthermore, if everyone could win, the game would lose its challenge and incentive and no one would want to play. HOWEVER, there is some intrigue in watching the game being played by others and watching their strategies of play and what they do to win and gain the advantage over other players. For this reason, there are countless new entertainment reality shows that people sit around and watch, but in which they would never dream of participating.

In this scenario, as mentioned, Monopoly® is the ONLY GAME IN TOWN! The players who have benefited from it are not likely to change the game and the rules that have so richly benefited them and their families. However, the countless people standing around watching the game are getting angrier and angrier, because they are not being allowed to play or are not benefiting from the game. These masses could easily disrupt the game, tip over the board, and kill the players. So, if the established players begin to realize this, these rich and powerful ones might think twice about changing the rules, affecting the way that the game is played, so that it would include benefits to the non-players.

So it is, in reality, that the few players take some of the money they’ve accumulated in playing the game and surround the playing area with armies and navies and appoint popes and priests that control the people and allow them, alone, to continue playing. Because of advancements in modern technology, a few players have the power to control the masses and protect the game. The people cannot overrun the military that is paid to only be loyal to those few players. Moreover, violence isn’t the answer either, because violent revolutions only lead to still other violent revolutions. Civilized people do not solve problems through violence. They solve conflicts through diplomacy and peer pressure.

As was stated above in hypothetically using Monopoly® as an example, “Just think how popular and well-liked those would be who helped the non-players by providing them with snacks and a comfortable chair from which to sit back and observe the game.” The players play to be recognized as rich and popular. We don’t want to eliminate their ability to obtain self-worth by being rich and popular. But we do want to help them see how changing the rules of the game will quiet the masses and make them even more popular and liked as they successfully play the game in a way that benefits those who aren’t involved in playing the game, or who don’t want to be.

Our proposed new Constitution establishes the new rules for the game that will accomplish what both the players and non-players expect out of being forced to be around each other in the same room where there’s only one game to be played.

The new Constitution gives Congress the actual equation from which it will determine taxation and the issuance of new currency. ALL TAXES WILL BE REPLACED with the set flat-rate consumption tax. Except for the fixed consumption tax, there will no longer be any duties, fees, or taxes on imports and exports. Imports are what foreign entities sell to America to consume. Exports are what America sells to foreign entities to consume. Both have the tax applied equally without loopholes and without exception.

Nothing is sold unless there’s a consumer who demands it. A free market, Supply and Demand Economy, has always been the best way to produce the most innovative and high-quality goods and services. But what about the not-so-good goods and services?

Wal-Mart imports a not-so-good quality product for $1, which, after the proposed tax, becomes $1.20. If the American consumer wants Wal-Mart’s product, the consumer will be forced to pay $1.40, plus whatever profit margin Wal-Mart wants to gain. The imported item is taxed twice, bringing in more revenue to take care of the basic needs of the American people (many who work for Wal-Mart and whose needs are not currently being met). This will affect the Wal-Mart profit margin according to supply and demand. Because if Wal-Mart wants to make a profit, it must stock products that the people want to consume. The higher the price of the product, the less likely the people will consume it en masse.

HOWEVER, having their life needs provided for them by law, the people won’t be forced to buy from Wal-Mart. If Wal-Mart wants to sell good, nutritious food that is better than other stores, then this is where it makes its money, because selling these law-mandated products, there IS NO CONSUMPTION-BASED TAX APPLIED! (As a reminder, this is because the law-mandated basic necessities are given FREE to the people of the Republic.) This motivates Wal-Mart to increase the quality of its products; especially those that people need to consume to live. If Wal-Mart doesn’t provide an apple that is as good as the apple that a competitor provides, Wal-Mart will lose the business.

THIS WILL AFFECT THE FARMERS AND ORGANIC, HEALTH-BASED GROWERS! Ma and Pa Stores can now compete with Wal-Mart by providing a better apple than Wal-Mart, the people having the means provided to them by law to choose where they purchase the nutritious apple. Ma and Pa ARE GUARANTEED SALES IF THEIR PRODUCTS TASTE BETTER TO THE CONSUMER! And Ma and Pa, in providing the nutritious apple DO NOT HAVE TO PAY ONE CENT IN TAXES, and can pocket the money they make and go to Wal-Mart and buy the things that they don’t need. It’s only when they buy from Wal-Mart … the things that they don’t need … that Ma and Pa are forced by law to pay taxes.

Supply and demand runs the economy and benefits government tax revenue, improving the economy and thereby exponentially reducing the consumption tax rate. The people should not be taxed more than their individual economic situation allows. Whereas the GDP is the determining factor of an economy, it being the sum of all private consumption (consumer spending), government spending, corporate spending, and the averaged export/import amounts, it determines the overall strength of the people’s ability to pay taxes and still support their economy. All personal and business taxes are replaced by a flat tax on private consumption, corporate spending, and the average of export/import duties (exports-imports).